Student Banking

It's never too early to start healthy financial habits.

Free Checking with Cash Back

Earn 3% cash back on purchases for a maximum of $6 each month and ATM fee refunds¹

Cash Back Account Benefits

- Free checking with no minimum balance required

- Opening deposit minimum: $25

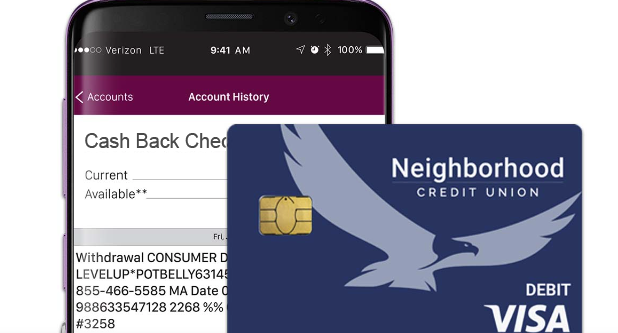

- Ages 13+ are eligible for a free debit card

- Securely manage accounts through Online Banking and Card Controls

- Money not in the account? Don't worry - purchases won't be approved if the funds are not available.

To Qualify for Cash Back Rewards

- Fifteen (15) individual or combined debit or credit card transactions of $5.00 or more post or settle

- AND ACH direct deposits that total $500 post and settle

- AND go paperless! Sign up to receive eStatements and decline paper statements

Membership Savings0.10% APY² |

| Minimum Deposit: $25 |

| A savings account for teens. Start saving for a car, college, or to simply begin healthy savings habits early! |

Certificates of Deposit3.50%-4.00 % APY² |

| Minimum Deposit: from $500 |

| Interested in putting your teen's savings to work? We have multiple terms and rates available for a low-risk investment in a CD. |

Christmas Club0.10% APY² |

| Minimum Deposit: $100 |

| A fun holiday twist to saving - save all year long and access your funds in early November. |

| Open now |

High Yield Savings2.75% APY² |

| Minimum Deposit: $10,000 |

| 24/7 access to funds and no maintenance fees. |

| Looking for somewhere safe to put your teen's large savings? Open a High Yield Savings and earn a higher rate than with a Regular Savings without locking up funds in a CD. |

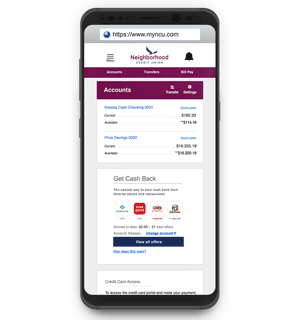

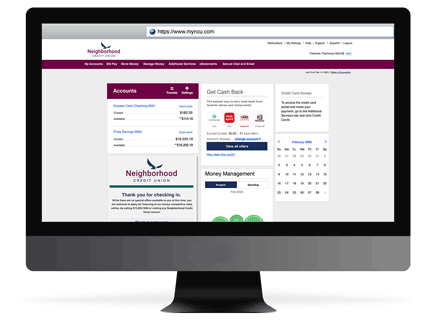

MyNCU Mobile

MyNCU Mobile

Mobile Deposit

Card Controls at Your Fingertips

Stay Contactless with Mobile Wallet

Biometric Security

Biometric Security

Our MyNCU Mobile app uses the latest in biometric technology to secure your teen's mobile banking. Access is easy using facial recognition, fingerprints, or a username and password.

Online Banking

Online Banking

State-of-the-Art Security

How do we keep your personal information safe?

What is the NCUA?

All Neighborhood Credit Union checking accounts feature:

Locations Across Dallas - Fort Worth

Alerts & Notifications

Simple Saver

Text Message Banking

Mobile Deposit

Card Controls

Money Management

Questions about our accounts or membership?

†Qualification Cycle = the first day of the month through the last day of the month.

1Cash Back Checking qualifications that must be met to obtain cash back rewards and ATM Withdrawal and Inquiry Fee refunds include: 1. Fifteen (15) individual or combined debit card or credit card transactions of at least $5.00 or more each (transactions may take more than one day to post/settle to your account) (Does not include RelyOn CU Credit Cards); AND 2. Have an aggregate of ACH direct deposits totaling $500 or more post and settle each qualifying cycle; AND 3. Sign up and agree to receive eStatements and decline paper statements. ATM transactions or transfers between accounts not valid for qualifying. Qualifying transactions must post to and settle account during monthly qualification cycle. Qualification Cycle and Statement cycle = first day of month through last day of month. If qualifications are met each monthly qualification cycle: (a) Domestic ATM withdrawal and inquiry fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle; and (b) you will receive 3% cash back on purchases up to $200 for a total of $6 per month on combined debit and credit card purchases. If qualifications are not met, no cash back payments are made and ATM withdrawal fees are not refunded. Minimum to open is $25. Account is free from a monthly service fee, other fees may apply. Fees may reduce earnings (see fee schedule). Limit one account per household. Federally Insured by NCUA.

²APY = Annual Percentage Yield.

View the Truth-In-Savings Disclosures.