Earn More with High Yield Checking & Savings

High Yield Checking |

0.01% - 4.00% APY1 |

| A free, interest-earning checking account. Calculate Your Potential Rewards | |

| ATM withdrawal fee refunds.2 | |

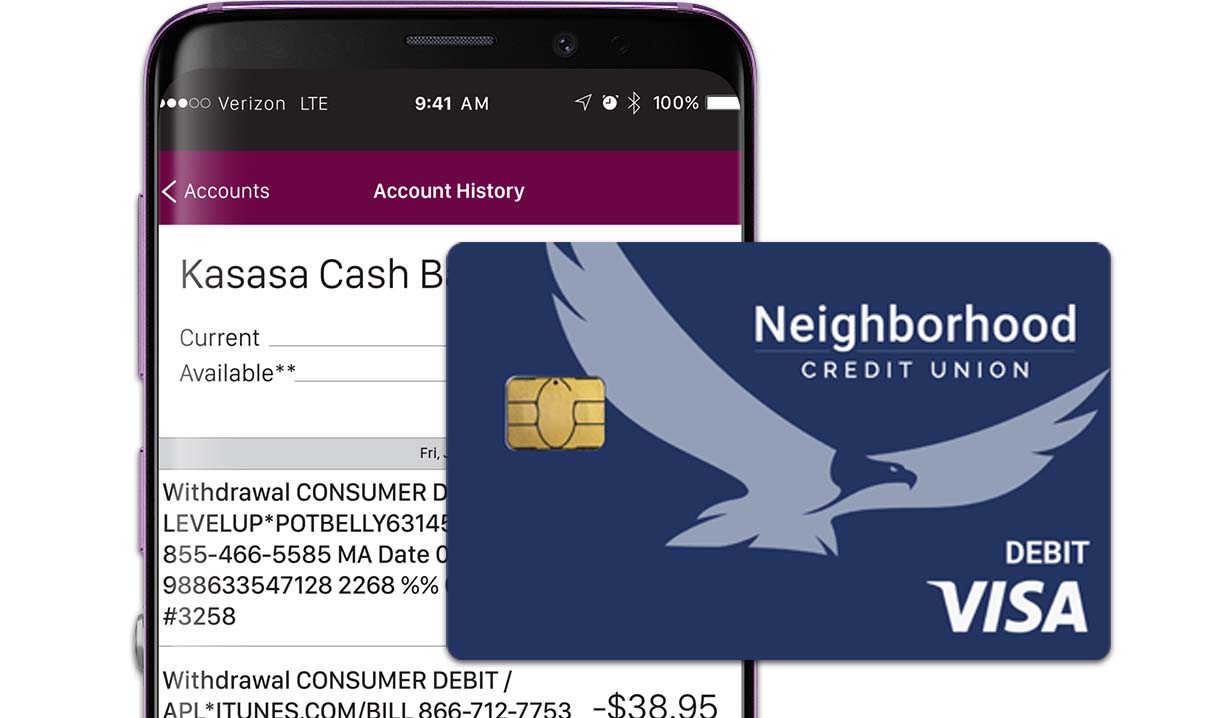

| Free Visa Debit Card that earns MyPoints | |

| No minimum balance required. | |

|

Upgrade your debit card to My Rewards Gold or Platinum.

|

High Yield Savings |

3.00% APY† |

| Minimum Deposit: $10,000 |

|

| 24/7 access to funds | |

| No minimum balance fees |

|

| Balances under $10,000 earn 0.00% APY† | |

|

|

open now |

1High-Yield Checking qualifications that must be met to obtain the Higher Interest Rate and ATM Withdrawal and Inquiry Fee refunds include: 1. Fifteen (15) individual or combined debit card or credit card transactions of at least $5.00 or more each (transactions may take more than one day to post/settle to your account) (Does not include RelyOn CU Credit Cards); AND 2. Have an aggregate of ACH direct deposits totaling $500 or more post and settle each qualifying cycle; AND 3. Sign up and agree to receive eStatements and decline paper statements. ATM transactions or transfers between accounts not valid for qualifying. Qualifying transactions must post to and settle account during monthly qualification cycle Qualification Cycle and Statement Cycle = the first day of the month through the last day of the month. If qualifications are met each monthly qualification cycle: (a) Domestic ATM withdrawal and inquiry fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle; (b) balances up to $50,000 receive APY of 4.00%; and (c) balances over $50,000 earn 0.10% APY on portion of balance over $50,000, resulting in 4.00% to 1.40% APY depending on the balance. If qualifications are not met, all balances earn 0.01% APY. Minimum to open is $100. Account is free from a monthly service fee, other fees may apply. Fees may reduce earnings (see fee schedule). Limit one account per household. Federally Insured by NCUA.

2ATM Withdrawal Fees: If qualifications are met each monthly qualification cycle domestic ATM withdrawal fees incurred during qualification cycle will be reimbursed up to an aggregate of $15 and credited to account on the last day of monthly statement cycle.

†High Yield Savings: *APY = Annual Percentage Yield. Rate is accurate as of 03/01/2023. Rates are subject to change at any time. Minimum $10,000 deposit required to open account. Minimum balance of $10,000 required to earn 3.00% APY with a rate of 2.96%, balances under $10,000 earn 0.00% APY. Three (3) withdrawals allowed per month, each withdrawal after will incur a fee. Federally Insured by NCUA. Please see the Rates & Fees page for details.

Open individually or combine these accounts for a better return in interest!

Upgrade to My Rewards® Premium Debit Cards

Upgrade to My Rewards® Premium Debit Cards

Join our exclusive members-only MyPoints Rewards program! Earn up to 3x more points every time you swipe your My Rewards® Gold or Platinum Debit Cards. Get rewarded for everyday purchases and accumulate points redeemable for prizes, trips, and gift cards!♦

|

It's a fast, secure, and straightforward method to send and request money. Whether you're splitting bills with friends or reimbursing family for shared expenses, Zelle offers a convenient solution so you can skip the hassle of visiting an ATM or dealing with cash.

|

Get paid up to 2 days early.**

Get paid up to 2 days early.**

**Neighborhood CU may give early access to direct deposit funds from your employer, payments and credits into your account, or government deposits and payments depending on when the deposit or payment file is submitted to Neighborhood CU. Weekends or bank holidays may affect the posting date. As a result, the availability or timing of early direct deposit may vary from pay period to pay period. Fraud prevention restrictions may apply and delay early availability of funds. Early availability is not guaranteed. Additional restrictions may apply.

All Neighborhood Credit Union accounts feature:

Set Up Direct Deposit

Surcharge-Free ATMs

Courtesy Pay

Send Money with Zelle®

Mobile Wallet

Earn Cash, Refer Friends

Find out if you're eligible

| Simply meet one of the below criteria OR be related to someone who does: | |

| Live or work in: |

Dallas County

Ellis County Denton County

Collin County

Tarrant County

City of Arlington |

| Live, work, worship, or attend school within a 10 mile radius of the branches in: | Coppell Grand Prairie Highland Village |

| Currently employed or retired from: | A Company Served by Neighborhood Credit Union Dallas United States Postal Service Arlington United States Postal Service |

| Become a member of the Neighborhood Credit Union Foundation, which is automatically done for you upon approval, and live in: | Texas |

| A member or potential member of the American Consumer Council and reside in one of the following counties: | Delta Denton Hunt Johnson Kaufman Parker Rockwall Tarrant Wise |

MyNCU Mobile App

Calculate Your High Yield Checking Interest Rewards

Why Neighborhood Credit Union is a great choice for checking, savings, and loans.

With over 90 years of experience, Neighborhood Credit Union knows how to help people reach their financial goals.

We now have several branches across the DFW Metroplex. We proudly provide our members with customized savings accounts and competitive rates.

As a not-for-profit, we pass savings on to you through greater returns. We also invest in technology to offer a top-of-the-class online and mobile banking experience. You can manage your accounts easily through online banking or our mobile app for iOS or Android.

At Neighborhood Credit Union, we’re committed to guiding you every step of the way toward financial security.