High Yield Savings Account

Earn more with an impressive 3.00% annual percentage yield on $10,000 or more.

How it Works

Earn an impressive 3.00% APY1 on a balance of $10,000 or more. Access your account at anytime to deposit funds or transfer to other accounts with Online Banking or the MyNCU Mobile App.

If your balance drops below $10,000 the interest will drop to 0.00% APY.¹

Minimum Opening Deposit

$10,000

Transaction Limits

You can make three (3) withdrawals each statement cycle for free. Any excess withdrawal will incur a fee.²

Account Features

Impressive 3.00% APY1

No Minimum Balance Fee¹

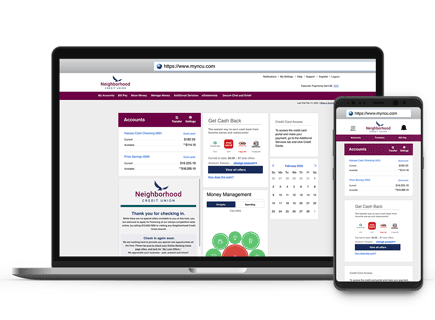

24/7 Online Banking & Mobile App

$10,000 Opening Deposit

1High Yield Savings: *APY = Annual Percentage Yield. Rate is accurate as of 03/01/2023. Rates are subject to change at any time. Minimum $10,000 deposit required to open account. Minimum balance of $10,000 required to earn 3.00% APY with a rate of 2.96%, balances under $10,000 earn 0.00% APY. Three (3) withdrawals allowed per month, each withdrawal after will incur a fee. Federally Insured by NCUA. Please see Rates & Fees page for details.

²More than 3 withdrawals per month will incur a fee. Please see Rates & Fees page for details. View the Truth-In-Savings Disclosure.

³Calculator is for illustration purposes only. Calculations are estimates of expected interest earned. Actual results may vary, based on various factors such as leap years, timing of deposits, rounding, and variation in interest rates.

All Neighborhood Credit Union savings accounts feature:

Want to compare savings accounts side by side?

Click the "Compare Accounts" button to explore in-depth.

Compare Accounts

Close

| Account Type | Summary | Minimum Opening Deposit | APY* | Fees |

|---|---|---|---|---|

| High Yield Savings |

24/7 access to funds, no maintenance fees, access to funds with 3 free withdrawals per month

|

$10,000 | 3.00% on $10,000 or more | If minimum balance is not maintained. See Rates & Fees page for current fees. |

| Money Market |

Low minimum opening deposit, tiered interest rate, access to funds with 6 withdrawals per month

|

$1,000 |

$1,000-$9,999.99: 0.10%

$10,000 & up: 0.10%

|

If minimum balance is not maintained. See Rates & Fees page for current fees. |

| 60 Month Certificate of Deposit |

Low risk, interest rate compounded daily

|

$2,500 | 3.25% | Interest penalty may apply for early withdrawal |

| Christmas Club |

Withdrawals not allowed until funds are transferred into Prize Savings in early November

|

$100 | 0.10% | Early closure fee |

| Prize Savings |

Earn cash and prizes during weekly, monthly, and an annual grand prize drawing

|

$25 | 0.10% | If minimum balance is not maintained and no other loan or deposit relationship exists. See Rates & Fees page for current fees. |

| Individual Retirement Savings |

Save for retirement with a Traditional IRA or Roth IRA

|

$100 | 0.10% | None |

| Special Savings |

Use to separate your funds for special purposes. Login to Online Banking to open online

|

$25 | 0.10% | None |

| Kid's Savings |

For kids ages 0 through 12

|

$25 | 0.10% | None |

*APY = Annual Percentage Yield

3.95% APY* 17-Month CD

An online-only CD offer that allows additional deposits.

Frequently Asked Questions

For the High Yield Savings Account, interest is compounded monthly.

Once a particular range is met, the dividend rate and annual percentage yield for that balance range will apply to the full balance of your account.

The Annual Percentage Yield reflects the interest rate and the effect of the frequency of interest compounding (for example, daily) during a 365-day period. The Interest Rate is the annualized rate applied to the principal balance of the account each day in order to determine the amount of interest that has accrued on that day’s principal balance.

Please see Rates & Fees page for current fees. View the Truth-in-Savings Disclosures.