Debit Card Rewards

It's easier than ever to earn cash back from your favorite stores - no coupon clipping required!

Start earning rewards today!

Register in Online Banking or the MyNCU Mobile App

Activate the offers that interest you

Make purchases online or in-store with your debit card

Receive cash back in your account*

How To: Sign Up for Debit Card Rewards

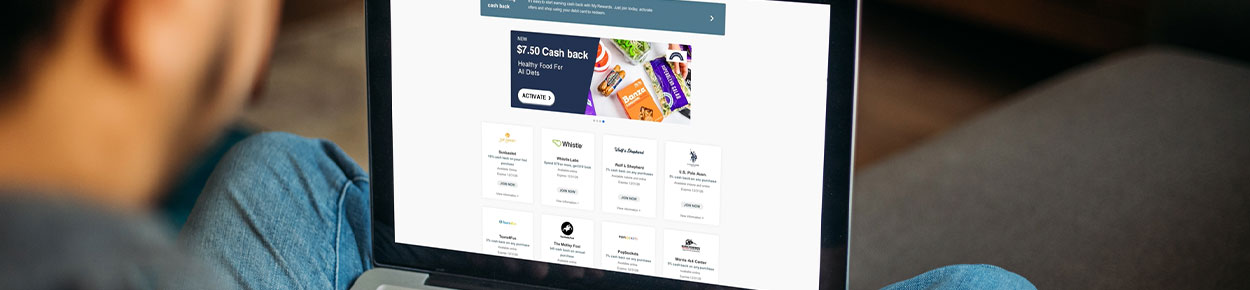

Access Debit Card Rewards in Online Banking by clicking on "Debit & Credit Card" in the toolbar and then "Debit Card Rewards" or in the MyNCU Mobile App by tapping "More" and then "Debit Card Rewards" in the Debit & Credit Card section.

Start earning cash back by:

- Enrolling a checking account with attached debit card

- Search for and activate offers before you shop

- Complete a qualified offer using your debit card when you shop online or in person

- Receive your cash back credit to your account within a month of completing the activated offer

Begin earning cash back today with your Neighborhood CU debit card and Debit Card Rewards!

*Rewards will post to your account via ACH within the month after the offer is redeemed.

Already a member and want to open a checking account online?

Watch this short how to video on opening additional accounts in Online Banking.

Want to see which checking account is for you?

Click the "Compare Checking Account's" button to explore in-depth.

Compare Checking

Accounts

Close

| Account Type | Summary | ATM Refunds² | High Yield Interest APY¹ | Opening Deposit | Monthly Fee |

|---|---|---|---|---|---|

| High Yield |

Free checking with high-yield interest.

|

Yes | 0.01% - 4.00% | $100 | $0 |

| Cash Back |

Free checking with cash back rewards.

|

Yes | No | $25 | $0 |

| Priority |

Low Opening Deposit and Overdraft Fee Forgiveness.

|

No | No | $25 | $11.99 |

| Fresh Start |

Ideal for those with less-than-perfect checking needing to get back on their feet.

|

No | No | $25 | $20 |

| Minor/Student Accounts |

Better Than Free Checking Accounts

Earn high yield interest¹ or cash back rewards² with these free checking accounts.

Who We Are

Formerly known as Dallas Postal Credit Union, Neighborhood Credit Union opened its doors to its first members in April 1930, just months after the U.S. stock market crashed. During the Great Depression, when Americans’ trust in financial institutions were at their lowest, Dallas Postal Credit Union won that trust and loyalty of its charter members. In 2001, we officially changed our name to Neighborhood Credit Union, a name that more accurately reflects the diverse base of members from all over the Dallas area.

Neighborhood Credit Union now serves the entire state of Texas with over 56,000 members and assets that top $1 billion. Our ongoing effort to offer members convenient services in their communities and mobile access wherever they go has made us a top-rated credit union in the Dallas-Fort Worth area.