Who We Are

We are Neighborhood Credit Union, the first credit union in the Dallas-Fort Worth metroplex.

Unlike traditional banking institutions, our goal is not to make a profit from our customers. As a not-for-profit organization, we are in the business of helping people achieve their short and long-term financial goals for their families. Through unique products and community investment, including college scholarships and financial education, Neighborhood Credit Union helps its Texas neighbors improve their financial health and well-being.

A not-for-profit, member-owned, volunteer-directed financial cooperative that provides fiscally sound, economically creative banking solutions.

Who We Serve

Anyone who lives in the state of Texas is eligible for membership. Built on over 94 years of relationships and trust, Neighborhood Credit Union serves well over 65,000 members who are under-served by traditional banking institutions.

Growth at a Glance

94 years

62,000 members

$1 billion+

$17 million

Why Choose a Credit Union?

Earnings are returned to you in the form of better rates and lower fees.

We are a not-for-profit owned and governed by the members.

Credit Unions consistently offer better rates than the big banks.

Our Story

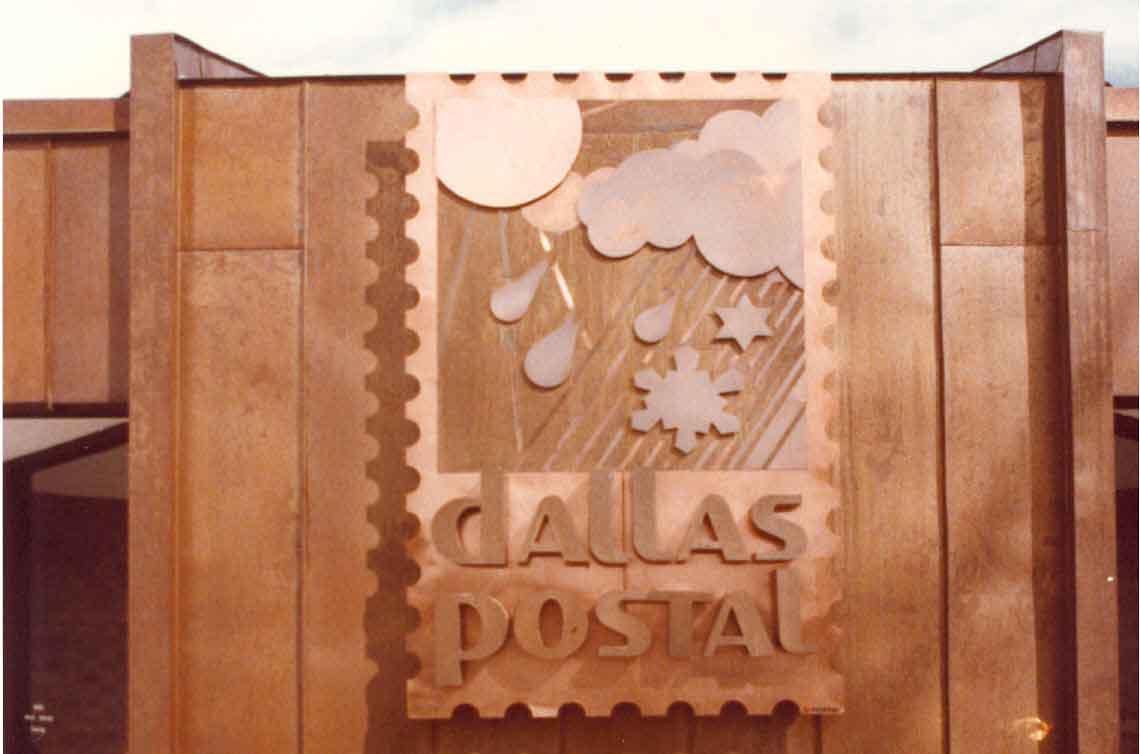

Originally known as Dallas Postal Employees Credit Union, Neighborhood Credit Union opened its doors to its first members in April 1930, just months after the U.S. stock market crashed. During the Great Depression, when American confidence in financial institutions was at an all-time low, Dallas Postal Employees Credit Union won the trust and loyalty of its charter members. In 2001, the credit union officially changed its name to Neighborhood Credit Union, a name that more accurately reflects the diverse base of members from all over the Dallas area.

Where We Are Now

Major Milestones

April 1930

In the spring of 1930, just months after the U.S. stock market crashed, the members of the Post Office Savings and Loan Association vote to organize the Dallas Postal Employees Credit Union

1940s

1958

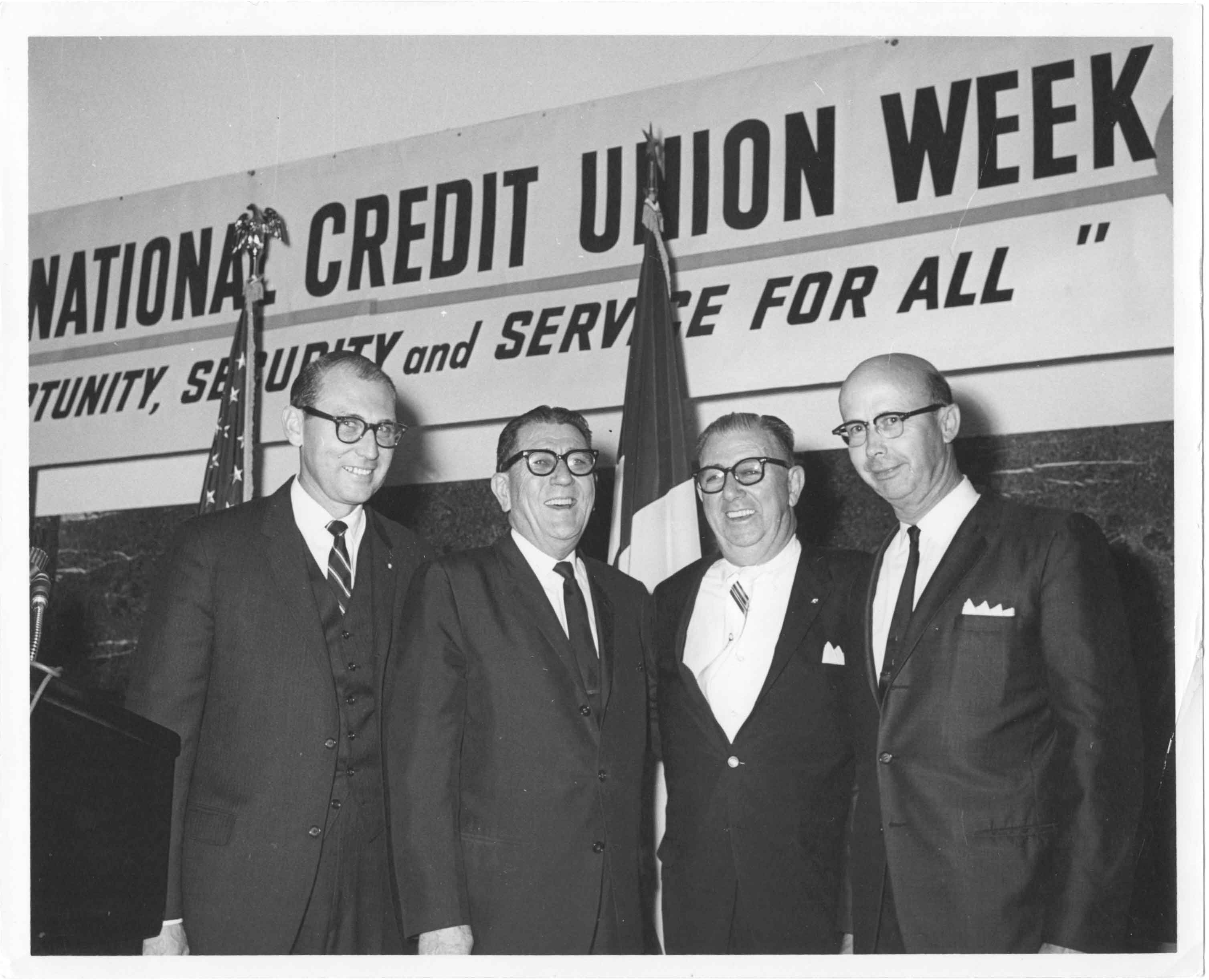

1960s

1970s

1980s

1990s

2001

2008

2010

2012

2013

2017

2018

2020

.png)

2020

2022

2023

2024

Want to grow with us?

About Neighborhood CU Foundation

.png)

Leadership

Events in Your Neighborhood

Become a Member

Annual Report

Did you know?

- Balance sheet and income statement

- Summary of the most recent annual audit

- Written board policy regarding access to the articles of incorporation, bylaws, rules, guidelines, board policies and copies, thereof

- Internal Revenue Service Form 990

Dwayne Boozer

Chairman

Neighborhood Credit Union member since 1970; board member since 1988; United States Postal Service veteran and retiree; Credit Union National Association awards: the Filene Award (1990), the Raiffeisen Award (1993), and the Technology Award (2003).

John Logan

Vice Chairman

Neighborhood Credit Union member since 1975; board member since 2013; former associate director 2008-2013; 37-year United States Postal Service veteran, retiring as a Postal Career Executive Service manager.

Lisa Salas

Director

Neighborhood Credit Union member since 1980; board member since 1996; 25-year United States Postal Service veteran, retired real estate specialist for the Southwest Area Facilities Service Office.

Arthur Young

Director

Neighborhood Credit Union member since 1963; board member since 1981; 39-year United States Postal Service veteran, retiring in 1997 as Postmaster for the City of Richardson. Credit Union National Association Awards: the Filene Award (1990), the Raiffeisen Award (1993), and the Bergengren Award (1995).

Randall Till

Director

Neighborhood Credit Union member since 1977; board member since 2013; 34-year United States Postal Service veteran, retiring as Postal Inspector in Charge, Fort Worth Division.

Jan L. Frum

Director

Former Pegasus Community Credit Union Board of Directors since 1993; she is the immediate past vice chairman; CPA in public accounting with Price Waterhouse and ExxonMobil, retiring in 2004; SOX Financial Compliance Director at EXCO Resources, retiring March of 2016.

Ronald Taylor

Director

Former Pegasus CCU member since 1975; Former Pegasus Community Credit Union Board of Directors since 1998; retired in 2014 from BlueCross BlueShield of Texas after 25 years as vice president and general counsel; a military veteran, retired with the rank of Lt. Col. from the U.S. Army Reserve.

Chet Kimmell

Chet Kimmell, has served as president and CEO of Neighborhood Credit Union since 1995. Under his leadership, the credit union assets have topped $1 billion and membership has grown to some 60,000 people. Chet served on the boards of directors for Town North Bank and SWACHA, where he is a former chairman of the board. He also has served on several committees of the Texas Credit Union League, including the TCUL PAC Advisory Committee. Kimmell earned a Bachelor of Business Administration from the University of Texas at El Paso and a Master of Science in Accounting from Texas Tech University.

James Frankeberger

James Frankeberger manages the accounting and finance areas, along with information systems, operations support, and facilities operations. A 20-year veteran of the credit union industry, he previously served as Director of the Dallas office of the accounting firm McGladrey and Pullen’s National Credit Union Division, where he managed over $30 billion in audit clients. James is a graduate of California State University at Fullerton with a Bachelor of Arts in Business Administration, with a concentration in Finance. He is also a Certified Public Accountant, licensed in Texas.

Kelly Gidney

Chief Risk Officer

Kelly Gidney leads the Internal Audit, Risk and Compliance areas for Neighborhood Credit Union. She graduated from the University of Texas at Dallas with a Bachelor of Science in Economics and Finance. She is also a Certified Internal Auditor through the Institute of Internal Auditors and a Certified Fraud Examiner through the Association of Certified Fraud Examiners. She has been in the credit union/ banking industry for over two decades, including both the examination and audit fields.

Carolyn Jordan

Carolyn Jordan leads the growth areas of the credit union, including the online and mobile digital channel, data analytics, special projects, product development, marketing, and advocacy. She graduated Magna Cum Laude from Texas A&M-Commerce with a Bachelor of Science in Business Administration. She also holds a Graduate Marketing Certificate from SMU’s Cox School of Business. In 2021, she earned her Master of Science in Business Analytics from Texas A&M University-Commerce. With over four decades of industry experience, Carolyn is well respected by her peers on the local, state, and national levels. Carolyn currently serves on the Consumer Depository Institutions Advisory Council for the Dallas Federal Reserve Bank, the Credit Union National Association Political and Grassroots Network, and the executive committee of the Texas Regional Chapter of the African American Credit Union Coalition (AACUC). She is a past Chair and current member of the Credit Union National Association (CUNA) Operations and Member Experience Council, a nationwide forum for credit union leaders.

Francis Santana

Senior Vice President, Retail

Bonnie Schmitz

Senior Vice President, Information Technology

Bonnie Schmitz leads the Information Technology operations at Neighborhood Credit Union; her experience spans almost three decades possessing a wide variety of highly specialized management, leadership, technical training and experience. A Certified Credit Union Executive, Bonnie currently serves as a member of both the Credit Union Executive Society and the CUNA Technology Council. Over the years she has successfully grown a large team of information security, data processing, network infrastructure, project management and business analyst professionals from a two-man operation to match the growth of Neighborhood Credit Union.

Kristi Brooks

Steve Boylan

Jessie Swendig

Senior Vice President, Marketing and Community Impact

Jessie Swendig leads the Marketing team, and has been with Neighborhood Credit Union since 2013. She graduated from Texas A&M University with a Bachelor of Science in Agribusiness and a minor in Marketing. Jessie served as a Young Professional Advisor for the Cornerstone Credit Union League and currently serves on the Board of Directors for the Dallas Chapter of Credit Unions.

Jessie lives in Wylie with her husband, son and two pups. They enjoy hiking, swimming, dancing and hunting for bugs - you can decide for yourself which one does which.

Kenny Cooper

Senior Vice President, Lending